Welcome

At Forecast Finance Limited, we believe in transparency and clear communication. This page is designed to provide you with important information about our residential lending advice service, our fee structures, our panel of approved lending suppliers, and how we manage conflicts of interest and complaints. We want you to feel confident and well informed at every stage of your journey with us.

Our Four Stages of Disclosure

There are 4 stages of disclosure; Public general disclosure (see below), Adviser Disclosure when we start working with you, Disclosure when we present our recommendation to you… and if you file a complaint, we’ll provide you with all the internal and external pathways for a transparent and timely resolution.

Forecast Finance Limited

General Disclosure Statement

Forecast Finance Limited

FSP Number: FSP1009677

Address: 2/57 Wiltshire Place, Somerville, Auckland 2014

Phone: 022 573 3515

Email: frank@forecastfinance.co.nz

Website: forecastfinance.co.nz

About Us

Forecast Finance Limited is licensed by the Financial Markets Authority (FMA) to provide financial advice services. Our advisers are individually registered on the Financial Service Providers Register.

Services We Provide

We provide advice and assistance on a range of home loan products, including:

- First home purchases

- Refinancing and debt consolidation

- Investment property lending

- Construction and renovation lending

We source mortgages from a panel of approved banks and non-bank lenders. Once we recommend a loan that fits your needs, we help you through the approval and settlement process.

Panel of Lenders

We currently work with the following lenders:

ANZ, ASB, BNZ, Westpac, Kiwibank, SBS Bank, TSB Bank, The Co-operative Bank, Avanti Finance, ASAP Finance, Basecorp Finance, Liberty Finance, First Mortgage Trust.

How We Are Paid

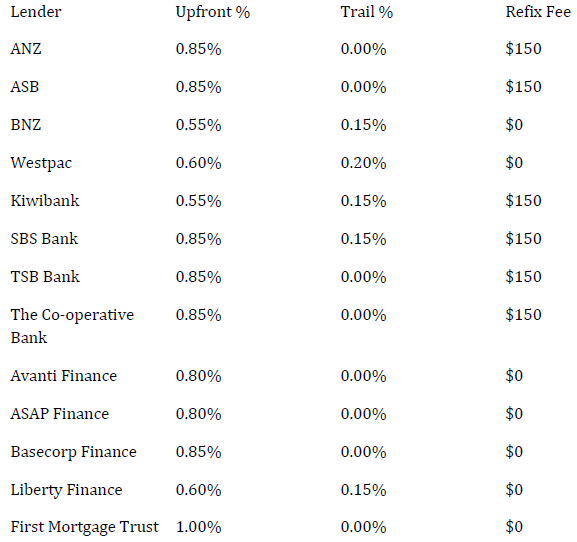

Forecast Finance does not normally charge clients an additional direct fee for advice. Instead, we are paid commission by lenders when your loan settles. This may include upfront commission, trail commission, or a refix fee.

The table below sets out the commission structures that currently apply:

Managing Conflicts of Interest

Although we receive varying levels of commission from different providers, our advice process is designed to place your interests first. We manage potential conflicts by:

- Recommending products based on suitability, not commission.

- Recording and disclosing all commissions, fees, and referral payments.

- Following our internal compliance and monitoring procedures.

Privacy and Information Security

We collect and hold personal information in line with the Privacy Act 2020. Your information is used only for the purpose of providing financial advice and arranging lending. We take confidentiality seriously and will not disclose your information without consent, except as required by law. For our full privacy statement, please refer to our website at www.forecastfinance.co.nz

Complaints Process

If you are unhappy with our service, please contact our Complaints Officer, Frank Zwitser, as soon as possible.

Phone: 022 573 3515

Email: frank@forecastfinance.co.nz

We will acknowledge your complaint within 2 working days and aim to investigate and provide a resolution within 2 weeks.

If we cannot resolve the issue, you can refer your complaint free of charge to our external disputes resolution scheme:

Financial Services Complaints Limited (FSCL)

Phone: 0800 347 257 or +64 4 472 3725

Email: complaints@fscl.org.nz

Physical Address: Level 4, 101 Lambton Quay, Wellington 6011

Postal Address: PO Box 5967, Wellington 6140

FSCL is independent and will help resolve complaints at no cost to you after we have gone through our internal complaints process

We hope you find this informative and useful, please don’t hesitate to reach out with any questions.

Contact us

Interested in working together? Fill out some info and we will be in touch shortly. We can’t wait to hear from you!